Purchasing real estate in New York City can feel like navigating through a financial minefield, especially when it comes to the array of taxes imposed on property transactions. Among these, three stand out for their imposing nature: the real estate transfer taxes, mortgage recording taxes, and the mansion tax. This blog aims to dissect these costs, critique their impact on the real estate market, explore their historical context, and provide strategies for potential buyers to manage or mitigate these expenses. Given the complexity and significance of these taxes, understanding them is crucial for anyone venturing into NYC’s property market.

The Trio of Taxes: A Deep Dive

New York State Transfer Tax:

- Rate:

- 0.4% for properties sold under $3 million.

- 0.65% for properties sold at $3 million and above.

New York City Transfer Tax (RPTT – Real Property Transfer Tax):

- Rate:

- 1.0% for properties sold under $500,000.

- 1.425% for properties sold at $500,000 or more.

- 1906: New York State introduced the transfer tax to raise funds for state operations.

- 1959: NYC implemented its version, initially lower but increased over time.

- The cumulative effect of both state and city transfer taxes significantly increases the cost of property ownership, potentially deterring sales or pushing buyers towards less expensive markets.

New York State:

- Basic Tax: 0.50% on the mortgage amount.

New York City:

- Residential Mortgages:

- 1.8% for mortgages up to $500,000 (effective rate after lender’s contribution)

- 1.925% for mortgages $500,000 and above (effective rate after lender’s contribution)

- Established in 1906, with NYC adding its tax later to support public services, notably the MTA.

- The tax adds an unexpected burden on top of the purchase price, particularly when combined with already high property costs and other taxes. It’s criticized for not being inflation-adjusted, impacting affordability.

New York City:

- Rate: Progressive from 1.0% to 3.9% based on the property’s sale price, kicking in at $1 million.

- Introduced in 1989 to capture revenue from luxury property sales, but its threshold has not been updated for inflation or market changes.

- Originally aimed at the ultra-rich, it now affects a broad spectrum of buyers due to escalating property values. The static $1 million threshold feels outdated to many.

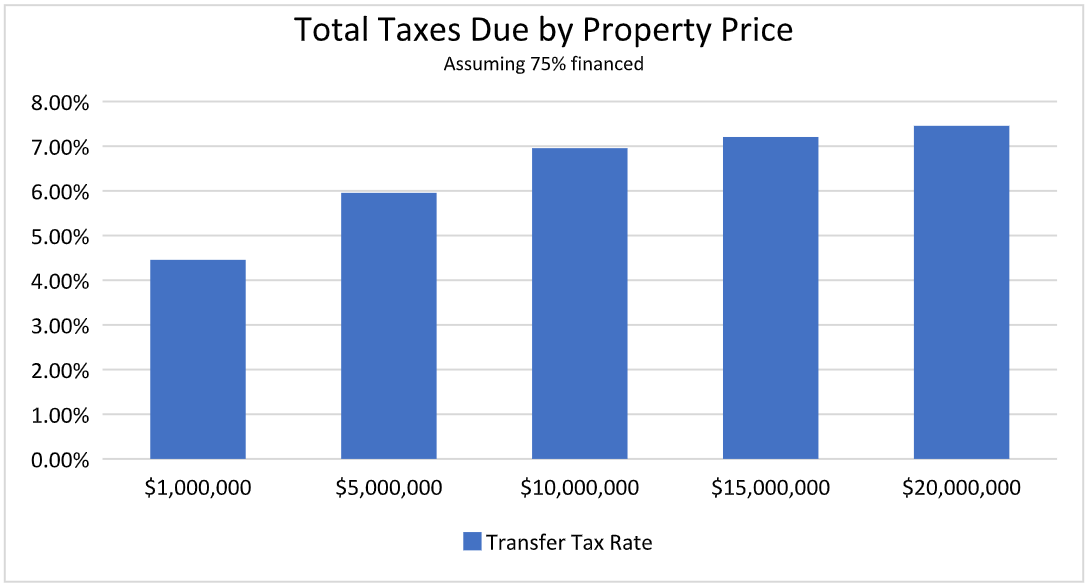

Total Taxes Due Upon Property Sale

To illustrate the aggregates taxes dues across various high-end NYC homes:

Strategies to Mitigate or Avoid These Taxes

- Co-op Over Condo: Co-op purchases avoid the NYC transfer tax and mortgage recording tax since they’re not considered real property but shares in a corporation.

- CEMA Loans: When purchasing or refinancing, a Consolidation, Extension, and Modification Agreement can significantly reduce or eliminate the mortgage recording tax by assigning an existing mortgage.

- Negotiation: Buyers might negotiate with sellers or developers to cover some taxes, especially in a buyer’s market or for new developments.

- 1031 Exchange: For investment properties, this can defer capital gains taxes, indirectly affecting how much you’re willing to pay in transfer taxes.

- Pricing Strategy: Sellers might price properties just below tax thresholds to avoid higher rates for buyers.

- All-Cash Transactions: While not avoiding transfer taxes, cash deals bypass the mortgage recording tax.

The Cumulative Effect on a $4 Million NYC Condo with a $3 Million Mortgage

Here’s a table illustrating how these taxes stack up:

| Tax Type | Rate | Calculation | Amount |

| NY State Transfer Tax | 0.65% | $4,000,000 x 0.65% | $26,000 |

| NYC Transfer Tax | 1.425% | $4,000,000 x 1.425% | $57,000 |

| NYC Mansion Tax | 1.5% (for $4M) | $4,000,000 x 1.5% | $60,000 |

| NYC Mortgage Recording Tax | 1.925% | $3,000,000 x 1.925% | $57,750 |

| Total Tax Burden | Sum of all taxes | $200,750 |

Analysis of the Taxes’ Impact

- Market Dynamics: These taxes can lead to a less fluid market where both sellers and buyers adjust their strategies around tax thresholds, potentially leading to price distortions or market stagnation.

- Affordability: For those not in the ultra-wealthy category, these taxes make NYC real estate even less attainable, contributing to the city’s housing crisis by pushing some buyers out of the market or into less desirable areas.

- Economic Considerations: The revenue from these taxes is justified by the need for funding public services and infrastructure, but the question arises whether these taxes are the most efficient or equitable way to achieve this.

- Public Perception and Policy Debate: There’s ongoing debate about adjusting these taxes, either by changing rates, thresholds, or exemptions, to better reflect current economic conditions while still meeting fiscal needs.

Conclusion

The real estate taxes in New York City, while providing necessary funds for public services, present a formidable challenge for buyers. The transfer, mortgage recording, and mansion taxes, in their current structure, not only add to the cost of entry but also influence market behavior in ways that might not always serve the city’s long-term housing needs or economic vitality. For buyers, understanding these taxes is the first step; leveraging strategies to mitigate their impact comes next. As NYC evolves, so too must its tax policies, aiming for a balance between fiscal responsibility and housing market health, ensuring that the city remains vibrant and accessible for all potential homeowners, not just those who can navigate its complex tax landscape.

Lock It In!, LLC can Mitigate These Costs

What if there were options to mitigate these taxes? Now they can be deferred or reduced by using the proprietary lease-option product offered by Lock It In!, LLC. Visit LockItInFinance.com or email [email protected] to learn how our product lowers the cost of your NY State or NYC home, benefiting both buyers and sellers.

References:

https://www.nyc.gov/site/finance/property/property-real-property-transfer-tax-rptt.page#

https://www.tax.ny.gov/bus/transfer/rptidx.htm

https://www.tax.ny.gov/pdf/current_forms/property/tp584nyci.pdf